According to

historian Frederick Jackson Turner, the loss of America’s land frontier meant a

complete change in the American character as well as the gradual Europeanizing

of the United States. As Turner saw it,

the end of “free” land meant the end of democracy as well as the unique

American character that made the country great and, as Abraham Lincoln put it,

the last, best hope of earth.

The question now

becomes how to make a slick political slogan into something meaningful and (if

you’ll pardon the expression) make America great again — or great in the first

place, depending on your personal views in the matter. Nor does it have to be restricted to

America. True greatness of any country

consists in how well its institutions promote what Aristotle called “the good

life,” that is, people acquiring and developing virtue: “habits of doing good.”

Having given the

meaning and purpose of life and the secret of the universe, a program to make

America (or anywhere else) great again should be easy (and American) as (apple)

pie . . . conveniently ignoring for the sake of the argument that apples aren’t

particularly American, but probably developed in or around what is now

Kazakhstan in Central Asia, but we digress.

|

| As Central Asian as Apple Pie |

To begin, let’s

list the three main elements that inhibited or spurred America’s rather

astounding rise to greatness in the first place:

Bad (as in really, really bad): human chattel slavery.

We could go on for a few (thousand) pages how bad slavery is. Right now we’ll settle for saying it offends

against human dignity at the most fundamental level, and prevents or greatly

inhibits both slaves and masters from leading the good life of virtue . . .

which (as we noted above) is the whole meaning and purpose of life and the

secret of the universe.

|

| Sir Robert Peel: invented modern police and the Currency Principle |

Bad: One really, really lousy financial system.

What good is a financial system that not only is grossly inadequate for

the country as a whole, even in the aggregate, but limits even its inadequacies

to the rich, leaving everyone else completely out of the picture? Face it, the Currency Principle (as opposed

to the Banking Principle) is not any way to run a financial system. Or anything else.

Good with Some Bad: Focus on internal

development. This is good because a

country’s first concern should be whether its own citizens are meeting basic

wants and needs. This was bad in the

United States because of the way people were increasingly meeting their basic

wants and needs: a wage system job. Wage

slavery was replacing chattel slavery as the opportunity to own land or a small

business disappeared, and wasn’t being replaced by the opportunity and means to

own a small piece of a big business.

We don’t need to

talk about chattel slavery. Okay, we do,

just not now or in this discussion. What

we need to focus on today in the here and now is how to fix the system and make

America (do we have to keep adding “or anywhere else”?) great again. That means looking at ways to make people

owners of the vast commercial and industrial frontier so that internal economic

development can be carried out to the advantage of everyone, not just a

socialist or capitalist élite, and

take care of the money system at the same time.

Now, keep in mind

that the two good things we need to do to fix the two bad/good-with-some-bad

things must be done at the same time, not in sequence. All you accomplish by doing only one is to

think you’ve fixed the problem, when all you’ve done is put off the final conflict

(boy, that sounds apocalyptic).

And what are the

two things? One, fix the money and

credit system, and, Two, end the wage (slave) system. Fortunately, we can do one by doing the other

(or maybe it was doing the other by doing one).

|

| Leo XIII: People should own capital. |

First, and

foremost (again, we’re just listing this first, both have to be done at the

same time), arrange matters so that (as Pope Leo XIII put it in § 46 of Rerum Novarum), “as many as possible of

the people . . . become owners.”

The fact is, as

technology advances, it displaces human labor from production. We mentioned this in the first posting of this

brief series, but it’s a good thing to repeat it. Technology doesn’t create jobs in the

aggregate, it destroys them. Yes, there

are “new” jobs created to operate the technology, but (everything else being equal)

the net result is a reduction in the amount of human labor to produce

marketable goods and services. That’s

the whole reason for adopting machinery in the first place: to produce more at

less cost.

And that means

that as technology advances, the value of labor relative to technology goes

down . . . at the same time that owners of labor need to increase their income

to be able to purchase the goods and services available . . . otherwise, demand

falls, goods remain unsold, and production goes down, reducing the need for

human labor even more.

The

solution? As Louis Kelso noted more than

half a century ago in an interview in Life

magazine (for you millennials, Life

was a magazine. . . and it was printed on "paper" with pictures and everything), if the machine takes your job . . . buy the

machine! That way, you get the income

the machine generates, and you now have enough to live on instead of hoping

somebody will give you a handout or you’ll save a rich man’s life and he’ll

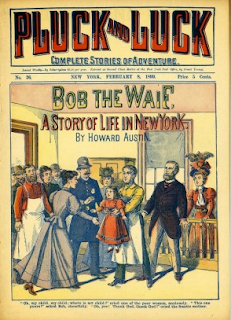

make you his heir in gratitude (it happens all the time in Horatio Alger

novels and clones).

Of course, not

all of us can get the chance to save a rich man’s life, and, frankly, there

aren’t enough rich men that need saving to go around. We need to have some way that doesn’t depend

on the rich that will enable people who are losing their wage system jobs to

the machines can buy the machines . . . but without taking anything from

anybody else. Especially any rich people

who might happen to need saving. You

never know. . . .

That leads us

directly into Two: fix the financial system.

The way it works now, only the rich who really don’t need the money can

borrow money to buy more and more capital.

That’s no help, because all that does is put more and more people out of

work. If the rich really wanted to help,

they’d start consuming (spending) more instead of reinvesting it to make even

more money that they can’t possibly spend.

And why are the

rich the only ones who can borrow money to buy new capital? Because they stole it from the rest of

us? No, because they have collateral,

that is, past savings.

You see, the best

way of financing new capital is not to accumulate savings. All that does is reduce demand and make any

new investment that much less likely to be successful.

No, the best way

to finance new capital is to promise to repay money out of the future profits

of the very new capital being financed that a commercial bank backed up by a

central bank creates! The rich have done

this for centuries . . . ever since the founding of the Bank of England in 1694

(actually long before that, but we do need a central bank in there to reduce

risk and for a number of other purposes, such as ensuring a uniform and elastic

currency).

“All you have to

do” (in this case we’re serious, although those words are usually a danger

sign) is make certain everybody, that is, every child, woman, and man, has the

right to participate in new money creation for financially feasible capital

projects on an equal basis with everyone else.

|

| "Consumer credit rates? Even I am offended!" |

That’s pretty

important, because most people in the developed countries have incredible power

to create all the money they want . . . for consumption, not for production,

and at rather high rates of interest that would make even Shylock blush. It’s called “consumer credit,” and money is

created in the millions, billions, possibly even trillions of dollars worth

every day, by buying with credit cards, on account, or any of the other ways

invented to get you to part with money you don’t have.

The problem is

that most of us ordinary people don’t have the collateral essential to

participate in new money creation for capital projects. That’s why Kelso figured that it would be a

good idea to replace traditional forms of collateral with capital credit

insurance and reinsurance, buying an insurance policy that would pay off in the

event the borrower defaulted on the loan.

And how can this

be done? By turning a contract to repay

the purchase of capital out of future profits (called a “bill of exchange”)

into money (called “money”) — which is what commercial banks and central banks

were invented to do (a different kind of bank lends out past savings; a

commercial or central bank actually creates money out of existing assets,

usually contracts, i.e., bills of exchange).

In this way the entire financial system can be reformed simply by

changing how money is created, and thereby shifting from a money supply backed

with government debt, to one back with private sector assets.

There is, of

course, much more to this, which can be found in the description of Capital Homesteading on

the CESJ website.

#30#