A recent book about money — and that coincidentally costs a lot of it — is John Cochrane’s The Fiscal Theory of the Price Level, which came out in January of this year from Princeton University Press after being revised. It seems that new data keep flowing in that require the basic theory to be tweaked continuously or it will drift too far from plausibility and some typos seem to have sneaked into the original version.

That being said, this is not a review of Cochrane’s book, and should not be taken as such. In order to review a book fairly, you need to have something in common with it, e.g., you must like that type of book, or be in some sort of sympathy with it. You would not, for example, have someone who loves mystery stories but hates western stories review a western, or vice versa. It’s not fair to readers or authors. Also, if you have a grudge against an author, you really don’t want to review anything by him or her. Readers will find out why you hate the author, but very little about the book.

Now, we don’t have a grudge against Cochrane. And we certainly like books on economics and money; we’ve written some ourselves. The problem is we’re binary economists here, and Cochrane is (or at least appears to be) Chicago/Monetarist. That might not mean much to a lot of people, but to a binary economist, asking him or her to comment — fairly — on a Keynesian, Chicago, or Austrian book on economics is a little like asking a Muslim to critique a book on Jewish theology. You might find out where Islam and Judaism differ on the subject, but you won’t learn very much about the book being reviewed.

|

| John H. Cochrane |

The fact of the matter is that binary economics differs from the three mainstream schools of economics on two fundamental points that make analysis virtually impossible, except to say that Chicago economics is not binary economics. The first of these is that all three mainstream schools of economics view money and credit as a commodity with which you carry out economic transactions. The second is the fixed doctrine that the amount of money and credit in the economy determines the level of economic activity. Combined, these form what is known as “the Currency Principle.” It is expressed mathematically in the Quantity Theory of Money equation as:

M x V = P x Q

where M is the quantity of money, V is the “velocity” of money (the average number of times a unit of currency is spent in a year), P is the price level, and Q is the number of transactions. The formula was developed by Dr. Irving Fisher and as interpreted means that if you want to affect V, P, or Q, you have to manipulate M, the quantity of money.

|

| Irving Fisher |

When it comes to controlling inflation, the three mainstream schools of economics throw a curve ball into the game for each defines inflation differently. To a strict Keynesian, inflation means a rise in the price level after reaching full employment. To a Monetarist, inflation means a rise in the price level due to too much money “chasing” too few goods and services. To an Austrian, inflation means any increase in the money supply, period. This means that no matter what anyone does to combat inflation in one of the mainstream schools of economics, it will almost automatically come into conflict with the other schools.

Here’s the problem: the Currency Principle assumes as a fundamental doctrine that the quantity of money determines the level of economic activity. Thus, monetary and fiscal policy is dictated by what happens when those in authority either manipulate M or leave it alone. Cochrane’s analysis in his book is based on this fundamental doctrine, and within the Currency Principle framework, it is brilliant, and true as far as it goes . . . which is up to the limit of the Currency Principle, and is derived from the work of Milton Friedman.

|

| Milton Friedman |

It was Friedman who came up with the term “helicopter money,” or at least inspired it. He theorized that if there was an island that had X amount of money, and a helicopter came and dropped another X amount of money, the price level would exactly double, and nothing would change in real terms. Of course, Friedman assumed that everybody on the island would get the exact amount of new money as he or she had of the existing money, and that human psychology would no longer function, e.g., when someone who formerly had $100 and saved $50 now has $200 and still saves $50, but spends $150 instead of $50, causing the price level to more than double by tripling effective demand. Going by Friedman’s theory, the price level would triple, not double, and the savings rate would be cut in half.

There is also the problem that when you have one equation with three dependent variables, you can’t really be sure how they will react in real life when you change the independent variable. Under the Currency Principle, M is the independent variable, while V, P, and Q depend on M; they are dependent . . . but the formula doesn’t say how they are dependent! You need other equations for that, and no one has ever developed them. Friedman just assumed that the velocity of money and the number of transactions would remain constant and only the quantity of money and the price level would change. That is clearly not the case in real life.

It appears that Cochrane realizes these weaknesses in Friedman’s theory and has taken exhaustive steps to refine it. As Cochrane summaries his own version of Friedman’s theory: “The fiscal theory of the price level offers a simple answer: Prices adjust so that the real value of government debt equals the present value of taxes less spending. Inflation breaks out when people don’t expect the government to fully repay its debts.”

That’s as far as we can go in analyzing Cochrane’s book. This is because binary economics is based on the Banking Principle, which is that the level of economic activity determines the quantity of money, not the other way around. This renders any analysis of Cochrane’s book from the Banking Principle perspective completely meaningless, because the fundamental and defining doctrine of the two schools are exact opposites. What is down and white in Currency Principle economics, is up and black in Banking Principle economics. There is no comparison because there is no basis for comparison.

|

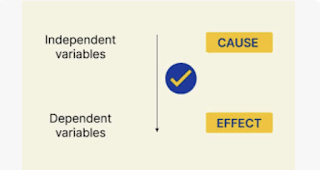

| The Currency Principle confuses cause and effect. |

To take the most obvious difference, where under the Currency Principle in the Quantity Theory of Money equation M is the independent variable and you have three dependent variables — mathematical nonsense if you want to solve the equation — under the Banking Principle you have three independent variables (V, P, and Q) and M depends on them. This easily solves for M because you only have to know V, P and Q, which can be empirically determined. There is no guesswork involved.

|

| Mister Feynman was not joking. |

Thus, where under the Currency Principle you don’t really know what’s going to happen to V, P, and Q when you add or subtract money from the system, under the Banking Principle, M gets solved automatically by letting people engage in economic transactions freely without anyone trying to manipulate the money supply. This is because money and credit are not a commodity as the Currency Principle assumes, but a means of measurement. Money is a symbol of value; it is not itself value.

The Currency Principle is, in fact, an example of what Richard Feynman called “Cargo Cult science”: people confusing the symbol with the thing symbolized. They then tie themselves in knots and ruin economies by trying to force results by manipulating the symbol itself instead of the thing symbolized. Like Cargo Cultists, they work to create the signs of a thriving economy and assume reality will follow; they put the cart before the horse.

The Banking Principle recognizes that production, distribution, and consumption all create, use, and cancel money. Production, distribution, and consumption actually precede or accompany the creation, use, and cancellation of money, money does not cause production, distribution, or consumption. Reality must come before the symbol it creates’ reality is not a reflection of a mystical ideal, rather, ideals are a reflection of reality. The world is Aristotelian, not Platonic.

That is why the sooner we adopt the Economic Democracy Act, the better.

#30#