As we hinted yesterday, the real problem with fractional

reserve banking is not that it permits commercial or mercantile banks to create

money. That is what such banks — a

combination of banks of issue and banks of discount — were invented to do. No, the problem is more subtle than that.

|

| Medieval Banking: Making Loans |

Let’s take a scenario.

Assume that a bank opens for business with $1 million in capitalization

and deposits. The legally mandated

fractional reserve requirement is 20%.

What does the bank do?

Assuming that the bank’s loan officers are being prudent

within the established framework, they will make $5 million worth of loans as

fast as they can. Anything less means

that the bank has idle cash in the form of excess reserves, which it may or may

not be able to lend to other banks that are short of reserves.

|

| Institution of Glass-Steagall in 1933. |

By the way, we’re also assuming that Glass-Steagall or something

similar is in operation, and the bank can’t go and put its excess reserves into

the stock market where the speculative returns tend to be greater than are

generally realized through the business of making commercial loans. No, the only thing this bank can do is make

loans, take deposits, discount bills, and issue promissory notes.

You see the problem, of course. A loan officer who doesn’t make loans up to

the maximum is costing the bank money, and that will probably cost him or her

that job. It is irrelevant whether there

is less than $5 million in feasible loans, or much more. The target is $5 million in loans.

Of course, a loan officer will do due diligence of a sort to

verify that it is a “good” loan. In the

back of his or her mind, however, will always be the urge to fudge a little,

especially if upper management or some government agency is putting on the

pressure to make certain types of loans that the bank ordinarily wouldn’t

touch. Many experts blame the home

mortgage meltdown on this tendency to fudge a little, and start down the

slippery slope of making loans based on something other than financial

feasibility.

There is also the danger that reserves will be used for

purposes other than intended if a bank is permitted to own shares other than

its own stock. That is what happened

with the repeal of Glass-Steagall and the merging of commercial and investment

banking functions. Instead of making

commercial loans, banks will be tempted to go into the stock market, driving up

prices and giving the illusion of economic growth when, in fact, the economy is

actually stagnant or even contracting.

|

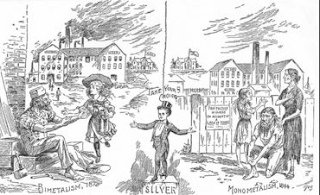

| "Money Famine" during the Great Depression of 1893-1898. |

It can go the other way, too. Feasible projects will go begging for

financing if the bank has already maxed out on the amount of loans it can make

constrained by the fractional reserve requirement. Economic growth will be unnecessarily

restricted, and a contraction of reserves can even trigger a financial panic

and a depression.

This happened in 1893, when foreign investors demanded

massive liquidation of American investments and required payment in gold — the

National Bank Notes, the reserve currency of the National Bank System, were of

no use to foreign investors. Gold

reserves plummeted, and banks began calling loans due to the bank not having

sufficient reserves to cover the loans.

Companies that had been “blue chip” only weeks before found themselves

insolvent, and the Panic of 1893 was in full swing, followed by the Great

Depression of 1893-1898.

|

| "Keep Off the Grass" |

The Panic of 1893 and the following Great Depression, by the

way, provided the impetus for the development of conspiracy theory; this gave

birth to the legend of “the Crime of ’73.”

Not understanding the role of reserves or how banks operate, many people

believed that “international bankers” were behind the lack of money and the

widespread unemployment, and it was necessary for government to assume control

over the whole of the money supply and start creating jobs.

The

demands of “Coxey’s Army” in 1894 were,

to all intents and purposes, a precursor of the New Deal — as many

recognized

when on May 1, 1944 Jacob Coxey gave the speech from the Capitol steps

he had

been prevented from giving in 1894 — being arrested for walking on the

lawn, making "Keep Off the Grass" a populist political slogan. The

various "armies" that converged in protest marches on the nation's

capital also gave us incomprehensible-to-modern ears aphorisms, e.g., "Enough food to feed Coxey's Army," "Hungry as Coxey's Army," "Ragged as Coxey's Army," "Dirty as Coxey's Army," and so on.

So, the big problem with fractional reserve banking is that

it alternately encourages bad loans and prevents good loans. This is not an insurmountable problem,

however, as we will see next week.