One thing about working in the field of theoretical and practical economics is that you get to hear all the really dumb things people say about money and credit. Almost as bad on occasion, and often worse (if you know anything about military science), are the things you hear about war. That’s why one of the worst movies of all time — at least from a moral point of view — has got to be Wall Street (1987).

Okay, that might need a little explanation. The film was well-acted, and it had a “moral” ending, at least according to Hollywood concepts of morality, i.e., the “hero” who betrays his mentor to the FBI repays his dishonest winnings and gets a job after prison with the company he “saved” in order to preserve union wage system jobs. The idea that the workers might actually own the company evidently didn’t occur to the scriptwriters.

Despite our ongoing support for widespread capital ownership for all (not just workers), that’s not the point we want to make today. Rather, we’ll begin by looking at the basic assumptions of Wall Street, which reflect many people’s ideas about war and finance, i.e., money and credit.

|

| Douglas in Wall Street |

First off, there’s the attitude many people have of the military. “Gordon Gekko,” played to the hilt (but not beyond) by Michael Douglas, is fond of quoting Sun Tzu’s The Art of War, an ancient Chinese military strategy manual. The problem is that he manages to avoid the most important lessons to be learned from Sun Tzu and assumes that what the book is about is winning by annihilating the enemy and achieving total victory at everyone else’s expense.

Wrong. Rule Numero Uno is never to go to war unless you can’t possibly avoid it. Only a fool starts a war he doesn’t have to start or a fight of any kind. Period.

Not that you do anything

to avoid war, for the enemy must be convinced that if you must fight you will —

and that if you fight, you will win, so it’s useless to attack you. It’s something of a paradox but being

prepared militarily — and letting everyone know it — is the best way never to

have to fight. (That was also the teaching of Flavius Vegetius Renatus in his Art of War, but Gekko didn't read Vegetius.)

|

| Sun Tzu |

You can’t appease or come to unacceptable terms to avoid war or any other kind of fight, for then you fall into the trap that Hitler led Chamberlain into. If someone promises you peace if you only give him what he wants now, the one thing you can be sure of is that he will keep on making demands because he assumes you won’t fight, and he can win without fighting.

If all else fails and you do end up in a war, the perfect military situation is to get the enemy to surrender without fighting. If you do fight, make certain you give the enemy the opportunity to surrender as soon as possible.

You do both by making certain that you leave the enemy a way out — making sure it’s the way you want the enemy to go. You don’t want to let the enemy to escape only to fight another day. You also never, ever, ever box the enemy in, leaving him with no way out except to fight to the death.

|

| John Maynard Keynes |

In short, your goal in any kind of fight is to get the enemy on your side, or to make him look like a complete fool or even insane if he still chooses to fight . . . which brings us to our subject for the day: money and credit.

In Wall Street as in everyday life, virtually everyone assumes that you can only make money if somebody else loses money. That’s largely the fault of John Maynard Keynes, the economic architect of much of the modern world (now you know who to blame).

Now, what Keynes did and why it’s so stupid is a topic for another day. What we’re looking at now is money as a weapon of war, or, ideally, of avoiding war if used properly; as Vegetius said, Si vis pacem para bellum, "If you desire peace, prepare for war," or something like that.

Keep in mind Sun Tzu’s (and Vegetius's) teaching that to be prepared for war is one of the best ways of avoiding it. Would Putin have taken over Crimea if he thought Ukraine or the West would stomp him down before he even got started?

|

| Do you really need a caption? |

Of course not. Putin is power mad, but not insane . . . yet. Even Hitler probably didn’t start out insane. That came later, when his easy victories convinced him he was infallible and thus a god (to which his fascination with the Occult, even if he didn’t initially believe it, probably contributed).

Nor — despite popular imagery — was Napoléon insane, just an extremely able, even brilliant opportunist, who figured out some rules of war that other people hadn’t fully considered before. For example, he knew that “An army travels on its stomach.” So, the Little Corporal sponsored a contest to see who could come up with the best method of preserving food for army use. Voila. Someone invented canning. Why is it even called “canning”? Because those little metal cylinders resembled canister shot, a really nasty artillery load you don’t want to hear about. Napoléon’s lightweight field artillery, named “napoleons,” of course, helped revolutionize warfare.

|

| A gold napoleon |

Napoléon also realized that a sound money system is essential to wage war. The French revolutionaries had made a complete mess of the national finances with their assignats and other government debt used as money. Almost Napoléon’s first act as First Consul was to reestablish the French monetary system and the national finances on a sound basis. Instead of worthless paper backed only by government debt, the monetary system was based on the gold twenty-franc piece . . . called a “napoleon,” of course . . .

Not that gold is the best basis of a currency, but it’s far better than government debt . . . excepting in certain circumstances debt incurred borrowing existing savings, even from bankers like Rothschild, who could be relatively certain that with Napoléon’s financial and economic reforms, he would get his money back . . . or take over the country if it wasn't (all government borrowing is bad, just some is less immediately disastrous).

|

| Hjalmar Schacht |

Napoléon also used money as a direct weapon of war, counterfeiting the Austrian currency (backed by government debt), which greatly assisted the Austrian government’s bankruptcy in 1811.

And Hitler? He, too, knew that a sound currency was essential. Der Führer left the reforms instituted by Hjalmar Schacht ten years before the establishment of Der Dritte Reich strictly alone. He had seen what hyperinflation could do to an economy and to national security. Many people are stunned to find out that the Reichsmark during and after World War II was still as sound as the U.S. Dollar. In one of the more foolish moves, in 1948 the Allies demonetized the Reichsmark and gave everybody a small amount of Deutschmarks, probably to break the power of the rich industrialists who had backed Hitler . . . but which only harmed wage earners and others who owned no capital.

|

| Putin as he sees himself? |

Putin at this point figures he has the U.S. and Western Europe over a barrel, especially considering the financial and military shape the U.S. is in. Sure, he has to worry about the Chinese, but even Hitler and Stalin were buddies for a while. Putin probably figures he can out-bluff Xi, just as Xi figures on putting one over on Putin, at least until the U.S. is out of the picture. Just speculation, but if the U.S. is out, China and Russia could easily start another war over who grabs Japan, Korea, the Philippines and India. Take a look at a map.

It looks pretty hopeless at the moment.

|

| Patton: Audacity |

There is, however, hope — IF the U.S. decides enough is enough and immediately implements the Economic Democracy Act. That one thing alone would give both Putin and Xi pause, if for no other reason that it’s unexpected. “L’audace, l’audace, toujours l’audace.” Putin and Xi would both have to stop and analyze what was going on, which alone buys time, and time in this kind of situation is priceless.

Even after a brief analysis, both Putin and Xi would start to have second thoughts. First, even without the expanded capital ownership, putting the U.S. and Europe’s (and Japan’s and Korea’s) monetary system on a sound, asset-backed, non-Keynesian basis would have an incredible effect on the global financial markets, and thus on the world’s economies.

|

| Do you really want to live like this? |

Then there’s the expanded ownership aspect. If all the new sound money were to be used to finance sound capital growth in a way that creates new owners (and thus create consumer purchasing and tax-paying power), the debt would stop growing and start shrinking. Further, all the existing money that would otherwise have been spent on new investment would have to go somewhere. One place is taxes to finance a military buildup — and don’t think that Putin and Xi wouldn’t realize the significance of that.

Another place for old money is research into new energy technologies. This would also be a legitimate use of government debt, but regardless how it’s financed, it’s significance would be unavoidable. Putin currently holds Western Europe hostage with his virtual monopoly on natural gas. What if Europe and the U.S. had a fuel supply that Putin couldn’t control, and was virtually unlimited, like hydrogen?

|

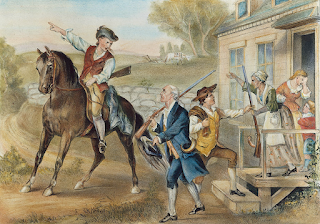

| Citizen-Owner Soldiers, or hirelings? |

We already have the technology. All it needs is bringing it up to speed to make it economically viable. And if it’s not yet there, it still doesn’t mean it can’t be used as a weapon of war. Hitler came to grief in part because he couldn’t secure enough fossil fuels. What if the Nazi scientists had developed hydrogen fuel?

The propaganda value of the Economic Democracy Act would be immense. It would build morale on the home front and discourage the Russians and Chinese. Every soldier in a Western army would know he or she was — or would be — fighting for him- or herself, while the Chinese and Russians would be fighting for . . . Xi’s and Putin’s gloire. That’s mighty discouraging. As even the ordinary Confederate soldiers were saying as the American Civil War dragged on, “Rich man’s war, poor man’s fight.” As Plutarch noted a few millennia ago, in his “Life” of Tiberius Gracchus,

|

| Tiberius Gracchus, Tribune of the People |

[The rich] therefore endeavored to seduce the people, declaring that Tiberius was designing a general redivision of lands, to overthrow the government, and put all things into confusion.

But they had no success. For Tiberius, maintaining an honorable and just cause, and possessed of eloquence sufficient to have made a less creditable action appear plausible, was no safe or easy antagonist, when, with the people crowding around the hustings, he took his place, and spoke in behalf of the poor. “The savage beasts,” said he, “in Italy, have their particular dens, they have their places of repose and refuge; but the men who bear arms, and expose their lives for the safety of their country, enjoy in the meantime nothing more in it but the air and light; and having no houses or settlements of their own, are constrained to wander from place to place with their wives and children.” He told them that the commanders were guilty of a ridiculous error, when, at the head of their armies, they exhorted the common soldiers to fight for their sepulchres and altars; when not any amongst so many Romans is possessed of either altar or monument, neither have they any houses of their own, or hearths of their ancestors to defend. They fought indeed, and were slain, but it was to maintain the luxury and the wealth of other men. They were styled the masters of the world, but in the meantime had not one foot of ground which they could call their own. A harangue of this nature, spoken to an enthusiastic and sympathizing audience, by a person of commanding spirit and genuine feeling, no adversaries at that time were competent to oppose.

Do we really need any other reasons to adopt the Economic Democracy Act as soon as possible?

#30#