The fun never stops around the Just

Third Way. One of the funnest things

(our grammar is as good as Keynesian Modern Monetary Theory, “MMT”) is the

absolute refusal of many commentators to realize that the Just Third Way, being

based on the binary economics of Louis Kelso and Mortimer Adler, is not your

usual past-savings based system. It’s a

past- and future-savings-based

system.

|

| A Bill of Exchange, based on financial feasibility, "creditworthiness." |

What does that mean? It means that the Just Third Way recognizes

two basic types of money: 1) Past savings based money backed by the present

value of existing marketable goods and services (i.e., “mortgages”). 2)

Future savings based money backed by the present value of future marketable

goods and services (i.e., “bills of

exchange”) based on “financial feasibility” (the ability of something to pay

for itself out of its own future profits).

In the Just Third Way framework, the

purpose of production is consumption.

Thus, the proper use of past savings is to spend it on goods and

services that you intend to consume. The

proper use of future savings is to finance the production of goods and services

intended for consumption.

|

| Inventories are not savings ... they're inventory. |

Two caveats right off the bat. 1) Inventories are not, strictly speaking,

“past savings.” They are stock in trade,

produced or acquired for sale or resale in order to realize a profit. 2) Government debt created by monetizing

deficits (“bills of credit”) are also not “past savings,” although that is how

they are construed in virtually all mainstream monetary theory. Bills of credit are backed by the present

value of anticipated future tax collections . . . that may never actually

materialize if the tax base has eroded or the government lost power.

|

| Salmon P. Chase: architect of the U.S. national debt. |

The problem is that mainstream monetary

theory treats both private sector inventories and government bills of credit as

if they were past savings, and ignores bills of exchange based on future

savings. This accounts for the emphasis

in modern economic theory on interest rates — which, strictly speaking, are

only valid when dealing with past savings.

Since the vast bulk of today’s money supply (and thus existing

accumulations of savings) is backed by distorted and ephemeral future savings

in the form of bills of credit, trying to achieve a sound and just financial

system by applying the wrong principles has, in part, created the horrifying

mess we see in the world today. . . ironically due in large measure to the National Bank system instituted in 1863 by Treasury Secretary Salmon P. Chase on bad — very bad — banking principles.

Now to a possible solution. A while back, possibly the early 1970s, Dr.

Norman G. Kurland, president of the Center for Economic and Social Justice,

came up with a proposal: the two-tier interest rate. (Since “interest rate” was something of a

misnomer, it’s been switched to “credit system,” but the substance has remained

the same, and you’ll still see the original term in older writings and when

there’s a slip of the tongue.)

|

| Norman G. Kurland |

The principle of the two-tier credit

system is simple: pay interest on loans on which interest is due, and don’t pay

interest on loans on which interest is not due.

(We’ve thought about a book on this that we would call Belloc’s Dilemma, or maybe Dystopia of the Usurers, showing how

Chesterton and Belloc’s distributism is handicapped by being trapped by the

past savings assumption, but we’ve never gotten around to it.)

Anyway —

The Two-Tiered

Credit System. To shift the

economy toward faster growth rates and broader participation in capital

ownership, the floor price on the cost of money would be determined by (1) the

nature of the assets behind the money, (2) the impact of the money on ownership

diffusion or concentration, and (3) the money’s source (i.e., “pure

credit” or “past savings).

Tier One: New Money (“Pure Credit” or “Future

Savings”). Credit and “new money” for Capital

Homesteading, i.e., feasible business projects linked to broadened

ownership, would be generated “interest-free” through the rediscount mechanism

of the central bank, at a service charge based on the cost to the central bank

of creating new money and regulating the lending institutions (possibly 0.5% or

less).

|

| Financing new equity issuances with future savings. |

The newly developed “pure credit

reservoir” would gradually supplant conventional sources of the economy’s

expansion capital, becoming the main source for financing the trillions of new

equity issuances representing the growth capital required by the economy in the

coming decade. The replacement of existing capacity (i.e., plant,

equipment and infrastructure) would continue to be financed in the usual way,

with profits generated by existing assets, so that the financing of growth

would not deprive present owners of any property rights in their existing

assets.

As explained above, pure credit is

based wholly on promises secured by the future profits anticipated from the new

capital investments, i.e., "feasibility." Because pure credit would be limited to self-liquidating

capital formation and would be cut off automatically by the Federal Reserve

whenever the economy operated at 100% of its capacity as a result of lack of

qualified paper to rediscount, “pure credit” is not inflationary. In fact,

because low-cost capital credit is geared to increasing production levels

without artificially raising labor costs and entitlements, it should bring

about lowered overall costs, and thus be counter-inflationary. “Pure credit”

should never be permitted for consumer financing, government deficits or for

speculating in previously issued securities or derivatives on the open market.

These would be financed through the “past savings reservoir.”

Tier Two: Old Money (“Other People’s

Money” or “Past Savings”). Credit and money

for nonproductive, ownership-concentrating uses would come from past savings (“old

money”). Yields on already existing investments (“past savings”) should be

permitted to rise to whatever levels the money market will permit. Interest

rates on “Tier Two” would, therefore, level off at yields on alternative

investment opportunities.

|

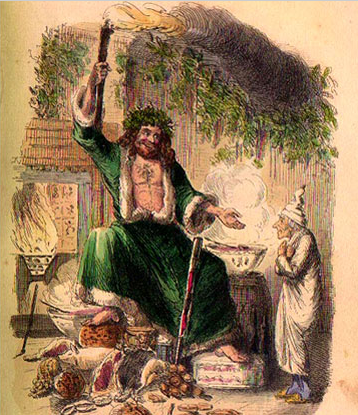

| "Share opportunity, Scrooge, not just your money!" |

Existing savings (to the extent present

owners do not convert them into funds for their own consumption) would be freed

up and channeled into reserves for capital credit insurers and reinsurers. This

would provide an expanded funding pool for consumer loans, housing loans not

financed through Homeowners Equity Corporations, highly speculative ventures,

loans for speculating in securities on the open market, small business loans,

Treasury bonds, and other risky or inflation-prone purposes. We wouldn't ruin Mister Scrooge, just take away his monopoly.

“Old money” would also be available for

building museums and monuments, or for funding charity, education, and other noble

worthy causes. Since this separate reservoir would not increase the output of

marketable goods and services to any appreciable degree, its interest rate

might contain an “inflation premium” to offset inflationary pressures arising

from the use of these funds for stimulating consumer demand or for wasteful and

speculative purposes.

An added benefit from shifting from

past savings to future savings for new capital formation would be to free

enormous resources to help the poor without harming the private sector’s

ability to finance new capital formation and create jobs. Given the focus of

many religious leaders (such as Pope Francis) on the need to increase aid to

the poor, Capital Homesteading has the potential to vastly increase resources

available for that purpose and, at the same time, decrease the need for such

assistance.